As extreme climate events propel the topic further into the mainstream it seems everyone is talking about Sustainable & Responsible Investing (SRI).

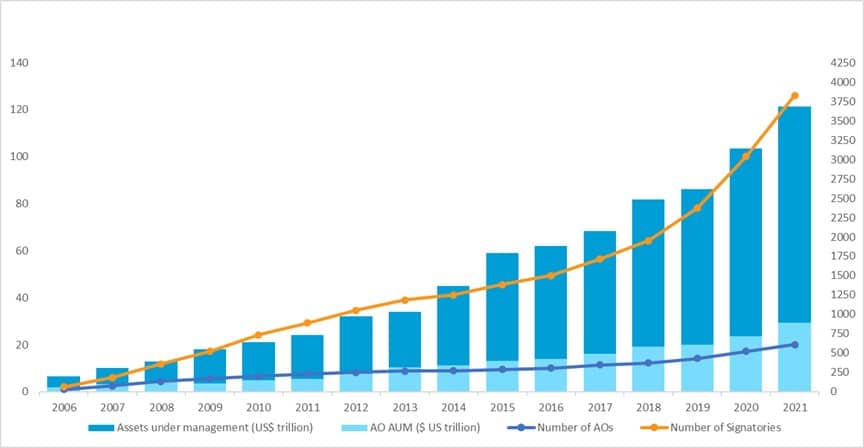

As I write, over 3,800 investment organizations with over $120 trillion in assets have now signed up to the United Nations’ Principles for Responsible Investment (PRI) initiative to integrate ESG information into their investment decisions. While not every signatory is yet managing assets sustainably, almost a third of all global investable assets are thought to be invested with sustainable considerations.

Source: UNPRI

The ascent of responsible investing is not confined to declarations of good intent. Instead of SRI, ESG and Impact investment criteria being a costly tradeoff, evidence is growing that using sustainability criteria magnifies long-term investment performance. Meanwhile, regulators worldwide are tightening up disclosure rules to increase the availability and reliability of ESG information – since insufficient ESG data quality has been identified as a key barrier.

With many drivers behind it, new ways to incorporate sustainable investing into your investment portfolio are multiplying in all asset classes. Once the sole preserve of a few specialty institutions, it has gained traction with large institutional investors, many of whom are offering products to retail investors.

In each of the six sections of this guide, we highlight the latest digital resources, tools, and technologies, all of which are easily accessible to anyone, to strengthen your toolkit and help you make better sustainable and responsible investment decisions faster. Of course, inclusion here is for informational purposes only and does not imply our endorsement or solicitation. You should always evaluate your own circumstances, conduct adequate due diligence, and take your own professional advice before committing to any investment.

We have labeled each resource as a short or long read to give you an indication of what you are getting into or downloading.

Top Eight SRI and ESG Investing Resources

Whether it is called Sustainable and Responsible Investing (SRI) or Environmental, Social and Governance (ESG) investing, both these labels flag the idea of doing good at the same time as investing well. Our top eight sources will help you navigate with confidence and invest sustainably.

- Eurosif, the European Sustainable Investment Forum, provides an overview on Sustainable Finance, definitions, regulatory and industry development from a European perspective. They also publish a definition on responsible investment strategies.

- US SIF, the US Forum for Sustainable and Responsible Investment is the US counterpart of Eurosif and provides an overview of the sustainable and impact investment sector from the American perspective.

- Sustainable Investing Basics is a guide from the US SIF. With a US focus, it covers definitions, motivations, strategies, market size, and growth rates alongside an introduction to shareholder engagement. Short read.

- Sustainable Development Goals form part of the United Nation’s PRI initiative, the broadest tent in the sustainability field. This guide explains why the UN’s 17 Sustainable Development Goals (SDGs) are relevant to all investors, why there is an expectation that investors will contribute, and the case for why investors should want to invest sustainably. Long read.

- A Guide to ESG Investing for Investment Professionals by CFA Institute, a global professional association for investment managers. This introduction covers the various definitions of sustainable investing, their scope, topical issues, methodologies, and debates. A long read but worth it.

- The Global Sustainable Investment Review from the GSI Alliance maps out the global marketplace and growth rates of sustainable and responsible investment across major financial markets globally, combining regional data from the United States, Canada, Japan, Australasia, and Europe. Long read.

- The International Sustainability Standards Board intends to deliver a comprehensive global baseline of sustainability-related disclosure standards that provide investors and other capital market participants with information about companies’ sustainability-related risks and opportunities to help them make informed decisions.

- The Principles for Responsible Investment (PRI) is a leading industry initiative focusing on the investment implications of environmental, social and governance (ESG) factors; and created an international network of investor signatories to incorporating these factors into their investment and ownership decisions

Source: United Nations Department of Economic and Social Affairs

Top Seven Climate Change SRI and ESG Investing Resources

We all understand that Carbon Dioxide (CO2) stays in the atmosphere and is causing the planet to overheat. In 2015 the world’s first functioning climate agreement, The Paris Agreement, set long-term goals to reduce global greenhouse gas emissions to limit temperature increases to 2 degrees Celsius while pursuing efforts to limit the increase even further to 1.5 degrees.

To reflect and minimize adverse impacts, investors must incorporate climate data into their analysis. Since so many emissions are from investable entities, a heavy burden of reducing emissions falls on investors and the greater alignment of environmental metrics with a low-carbon transition. Our resources cover the full spectrum of current and proposed approaches.

- The UN PRI hosts thought leadership and introductory material supporting links between climate change and financial impact. These address the four pillars of risk management identified by the Task Force on Climate-Related Financial Disclosures (TCFD). Long read.

- Climate Change Analysis in the Investment Process is a guide from CFA Institute with examples and case studies on how to integrate climate change-related data into the investment process. The guide includes an introduction to the carbon marketplace, TCFD, the Global Reporting Initiative (GRI), and the Climate Bonds Initiative. Long read.

- ESG Investing and Climate Transition report from the OECD aims to strengthen ESG practices to promote worldwide consistency, comparability, and alignment of environmental metrics with a low-carbon transition. Long read.

- The Transition Pathway Initiative tool helps investors understand low-carbon transition through a handy tool using independent data to analyze the world’s largest high-emitting companies and sectors. It generates useful insight into their transition journeys to align with international climate goals. Short read.

- The 2 degrees Investing Initiative (2DII) is an independent, non-profit think tank that coordinates some of the world’s largest research projects on sustainable finance.

- The Science Based Targets initiative (SBTi) provide companies with a clearly defined path to reduce emissions in line with the Paris Agreement goals. They developed a specific approach for financial institutions.

- Climate Change Investment Risks in 2022, a blog from JP Morgan Asset Management, provides regular short updates on climate change with useful infographics. Short read.

Top Five Faith-based SRI and ESG Investing Resources

Faith-based approaches share a focus with more mainstream SRI and ESG investors in considering ethics, stewardship, and social responsibility. A traditional feature of faith-based investing is a negative screening process to exclude investments such as alcohol, weapons, and gambling on religious grounds, but an expanding range of faith-based approaches and case studies can be explored using our resources.

- Investopedia’s A Guide to Faith-based investing is an informative and brief introduction. Short read.

- Zug Guidelines outline investment priorities for 30 traditions from eight of the world’s major faiths. Long read.

- Sustainable, Responsible, and Impact Investing and Islamic Finance: Similarities and Differences, a guidebook from the CFA Institute, finds similarities between Islamic finance and sustainable, responsible, and impact (SRI) investing. Long read.

- Faith in Finance report explores the links between the UN’s SDGs and faith investing for the future. Long read.

- A comprehensive blog by FaithInvest provides a practical case study of how it applies faith-based investing solutions to help clients. Short read.

Top Seven ESG Rating and Screening Tools

ESG rating and screening tools have long been used by professional investors to assist their investing and are now available more widely. Ever increasing regulation and accounting disclosure such as TCFD seek to improve the granularity and comparability of the data making screens more reliable.

It is worth knowing that there are differences of emphasis between the various ESG rating systems such as MSCI, Bloomberg and Morningstar. Independent researchers have found mathematical correlations between four ESG equities scoring systems ranging from 0.47 up to 0.76 (where 1.0 is the same and -1.0 is the opposite). This is not very high when compared to the correlation between rating agencies for US fixed income securities of 0.99. For this reason, most investors use several scoring systems.

- MSCI ESG Ratings & Climate Search Tools explore implied temperature rise, decarbonization targets, MSCI ESG Ratings and key ESG issues of over 2,900 companies. MSCI ESG data is also used to provide searchable ESG ratings on ETF.com

- On Morningstar’s platform, you will find a comprehensive ESG screener to be used alongside The Morningstar Sustainable-Investing Framework. Also, note the Morningstar Guide to ESG Screening (requires registration).

- Sustainalytics, a global ESG ratings provider owned by Morningstar, provides company ESG risk ratings for more than 4,600 companies. The ratings highlight ESG issues that Sustainalytics believes may pose a financially material risk to the company.

- ISS ESG provides climate data, analytics, and advisory services to help financial market participants understand, measure, and act on climate-related risks across all asset classes.

- S&P Global Trucost is part of the ESG data offering of S&P

- Hosted by USSIF, the Sustainable Investment Mutual Funds and ETFs Chart uses Bloomberg data to display all sustainable investment mutual funds and ETFs offered by USSIF’s institutional member firms. This public tool is intended for individual investors to compare costs, financial performance, and voting records of competing funds.

- AsyouSow, a non-profit foundation known for shareholder advocacy, provides thematic reports on topical SRI issues, as well as Sustainability Report Cards, for about 3000 US funds in collaboration with Morningstar. These reports are graded alphabetically on dimensions such as fossil fuels, deforestation, and gender equality.

Top SRI and ESG Investment Performance Resources

Skeptics regularly seize on evidence, usually short runs of data, to claim that ESG investing underperforms compared to “sin stocks”, or that an ESG focus distorts decision-making. Meta-studies, which are studies of not just one, but many data sets over long time periods, provide a strong rebuttal to these skeptics. There are several leading meta-studies worth reading.

- ESG and Financial Performance, Uncovering the Relationship by Aggregating Evidence from 1000 Studies. It finds evidence that ESG outperformance increased over longer periods and offers downside protection. It also finds ESG integration is a better approach than negative screening. Long read.

- ESG and financial performance: aggregated evidence from more than 2000 empirical studies. This study finds that the business case for ESG is very well-founded. Long read.

- From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance is another meta-study commissioned by Arabesque and Oxford University. 88% of their sources find that companies with robust sustainability practices demonstrate better operational performance, which ultimately translates into cash flows. The second part of the report finds that 80% of the reviewed studies demonstrate that prudent sustainability practices have a positive influence on investment performance. Long read.

- Honey I Shrunk the ESG Alpha is long-form research from the team at EDHEC Business School and Scientific Beta. This study finds that when you break down recent ESG returns there is a 75% overlap with the “Quality” quantitative risk factor and very little downside risk protection. They also found that the recent popularity of ESG strategies and buoyant fund flows have flattered returns. One journalist from the Financial Times concluded that the ESG outperformance narrative ‘is flawed’. While it is useful to know about incidental overlaps with quantitative risk factor approaches, it is important not to lose sight of the unique benefits, exposures, and influence that accrue to ESG investors over longer periods than the EDHEC study considers.

- GIIN’s report, GIIN Perspectives: Evidence on the Financial Performance of Impact Investments, condenses a dozen recent research reports on the performance of impact investments. It covers three common asset classes in impact investing: private equity, private debt, and real assets, as well as individual investor multi-asset portfolios. Long read.

Top Five Impact Investing Resources

Impact investing generates measurable environmental and social impact along with financial returns. Our resources encompass this growing marketplace, its investors, emerging markets and providers.

- From the Global Impact Investing Network (GIIN) a short Need-To-Know guide covers what impact investing is, global impact investment, market size and participants, investment performance, and current state. Short read.

- The Learning Hub of the Impact Investing Institute explores retail demand, how to communicate with investors about impact, impact portfolio building and how to undertake due diligence. Long reads.

- The Individual Imperative, Retail Impact Uncovered explores the drivers of retail adoption and future possibilities of impact investing through an extensive survey. Long read.

- The International Finance Corporation (IFC) and World Bank publish resources including their Operating Principles for Impact Management on this website with a focus on impact investing in emerging markets. Short read.

- The Impact Assets 50 is a showcase of impact investing managers, published by a provider. It is searchable by focus and geography among other parameters. Short read.

If you’d like to learn more about SRI Investing you can also check out the recently published ‘Sustainable & Responsible Investing 360°: Lessons Learned from World Class Investors’, which contains in-depth interviews with 26 leading SRI investors and you can obtain your copy here. You can also listen to the SRI360 Podcast, which features a range of interviews with world-class investors across all asset classes.