Recent years and events have raised awareness of the significant contribution of socially responsible investing to addressing today’s most pressing societal, economic, and environmental problems. Accordingly, the emphasis of investors has shifted from the sheer evaluation of financial returns to a more comprehensible analysis that includes the sustainable impact these investments can make.

Moreover, investors have developed a more sophisticated awareness of both risks and opportunities that arise from social or environmental issues.

This article will define Socially Responsible Investing (SRI) and discuss why it has become a prerequisite for all market stakeholders.

The Evolution of SRI

Socially responsible investing, or SRI, refers to an investment strategy that balances financial returns with social and ethical benefits. Socially responsible investments can, for example, be made by investing into companies with a good social value or by excluding those investments with a negative impact on society, for example tobacco companies (this approached is generally referred to a negative screening).

Although the acronym “SRI” is now commonly used by organizations such as EuroSIF, USSIF, and PRI as well as this website to refer to all types of sustainable and responsible investment strategies implemented in the marketplace today, the traditional definition only applies to Socially Responsible Investing and this article will therefore limit the discussion to its evolution throughout time.

The origins of socially responsible investment can be traced back to many places worldwide. One example are the Quakers, who were members of the Religious Society of Friends in the eighteenth and nineteenth centuries, and are most likely to be credited with its inception. At that time, the Quakers refused to engage in the slave trade or the purchase and sale of human beings.

Pax World, formed in 1971, is another historically significant institution. Luther Tyson and Jack Corbett, two United Methodist preachers, formed the first socially responsible mutual fund in the United States, initially conceived to allocate the church’s assets in a way that did not endorse the Vietnam War.

On the U.K. side, Friends Provident, a mutual life insurance firm, created the country’s first ethical investment fund in 1985, with criteria that prohibited tobacco, guns, alcohol, and authoritarian regimes. Since 1985, more than 90 investment funds with various impact criteria have been launched in the U.K.

Since the early 2000s, additional considerations beyond social responsibility gained importance: namely environment and governance issues.

On one side there were natural and man-made environmental disasters such as climate change, devastating Amazonas wildfires and oil spills such as the Deepwater Horizon and Exxon-Valdez oil spills; on the other side, outrageous corporate governance wrongdoing, such as the Volkswagen emission scandal, the manipulation of the LIBOR by large banks or the Enron accounting scandal. These major issues from the environmental and governance side not only impacted the definition of SRI and led to the development of the acronym ESG – the mentioned scandals also heavily impacted financial valuations.

In 2005, growing consciousness about the financial impacts of environmental, social and governance issues led to a landmark report by the law firm Freshfields. The report concluded that to take ESG issues into consideration is indeed a legal obligation and part of the fiduciary duty of institutional investors in most jurisdictions.

The Growth Story

Historically, many financial advisors have been sceptical of this investment approach. Sam Adams, managing director of Vert Asset Management, stated, “Too many advisers still link SRI funds with performance concerns; therefore, many are hesitant to provide or even advocate SRI investments”.

Nonetheless, the growing number of inflows into SRI or ESG funds and the financial materiality of ESG issues has prompted many investors to consider these strategies as a norm in their portfolio allocation process. Governments and international organizations are also significant drivers of this momentum, with numerous mandating businesses to comply with the new standards. The global push to achieve net-zero carbon emissions by 2050 and the Covid-19 crisis acted as an additional accelerator for SRI and ESG investments.

Although SRI originated as a modest practice linked with religious organizations, it has progressed significantly. It is now a common investment practice.

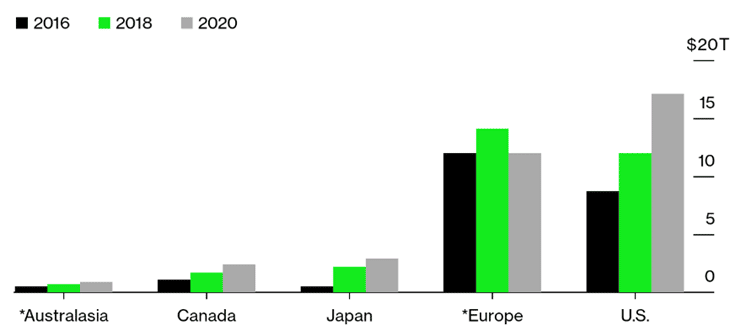

The value of global sustainable investments exceeds $35 trillion, according to the GSIA 2020 report. The GSIA defines sustainable investments as an approach that considers environmental, social and governance (ESG) factors in portfolio selection and management.

SRI Values: Avoiding ‘Sin’ and Embracing ‘Good’

As highlighted previously, socially responsible investing awareness (and components) has dramatically progressed over time. Initially used by religious institutions concerned about investing in “sinful” sectors, these standards became more widespread as investors’ ethical consciousness grew. For example, in the 1970s and 1980s, investors shunned companies that benefited from apartheid practices in South Africa. This ultimately led to the collapse of apartheid due to the lack of economic support.

In a more recent context, the major disruptions of the last several years had a tremendous impact on economic values, placing investment committees under even greater pressure to include purposeful investments in their pipeline. In a 2021 survey by the financial service company SEI, more than 30% of respondents said they were currently investing in SRI strategies or intended to do so. And 32% made “impact” investments directly in companies and organizations supporting their goals.

When approaching SRI, investors apply additional, non-financial criteria in their asset selection process.

Investment Screening

In essence, investment screening analyzes whether a company’s activities align with the values of an investor. While the traditional definition of SRI is inclusive, the evaluation predominantly incorporates organizations based on environmental, social, and corporate governance (ESG) standards in today’s market. Here are the typical components on which SRI screening is based:

| Environmental Issues | Social Issues | Governance Issues |

| Climate Change and GHGs | Slavery and Human Rights | Board Structure |

| Air/Water pollution and Scarcity | Labor Standards | Executive Compensation |

| Energy Efficiency | Health and Safety | Audit Committee |

| Waste Management | Womens’ Rights and Diversity | Corruption and Bribery Avoidance |

| Biodiversity & Deforestation | Data Protection | Lobbying and Political Influencing Activities |

When analysing organizations based on environmental factors, a filter may take into account how they report, manage and finally set targets to limit their greenhouse gas emissions. Companies evaluated based on social criteria often consider worker health and safety, gender equality within the organization, and workplace diversity. But the assessment doesn’t stop at the factory gates – with other words, not only the assembling line or what comes out of the chimney is relevant.

An ESG analysis usually also includes downstream and upstream activities. Upstream activities incorporate for example the supply chains of purchased goods and services (e.g. the social and environmental standards of supplier companies). Downstream activities include the transport and distribution of products as well as their use and “end-of-life” treatment.

For Boeing or Airbus this means that not only the emissions are relevant that accrue when assembling an airplane. Most interesting are the emissions that the produced planes emit during their lifetime. They are part of the so-called scope 3 assessment.

Airbus is reporting the estimated emissions of commercial airplanes sold (delivered) over their average lifetime. The 863 planes sold in 2019 translate to 740m tonnes of CO2 – roughly twice the emissions of the United Kingdom per year. Competitor Boeing decided against disclosing this information even though nearly all of Boeing’s shareholders have voted in favour of reporting this information.

How SRI funds utilize ESG ratings of companies

Two of the most popular types of SRI / ESG investment strategies are positive and negative screenings.

a. Negative Screening

Negative screening, also known as screening by exclusion, is a traditional SRI approach. It entails identifying organizations that perform poorly on environmental, social, and governance (ESG) aspects compared to their competitors. These companies are then omitted from an investor’s portfolio.

b. Positive Screening

Positive screening, in contrast, is focusing on companies or projects that are doing better than their competitors within a sector in regard to their ESG performance. This is also called best-in-class approach.

This allows investors to pick and promote good practices. Positive screening is far more proactive than negative screening.

It is also essential to discuss and contrast the concepts of impact investing and SRI to comprehend this field. Impact investing is the allocation of capital with the expectation of a financial return to produce measurable positive social and environmental impact. While socially responsible investment (SRI) and impact investing both consider ESG data, they differ in their requirement for verifiable social and environmental impact – SRI seeks to employ investment capital responsibly and beneficially, while impact investing necessitates that the change is, as its name implies, significant. In other words, impact investing attempts to proactively “do good” with investments, whereas SRI is limited to “do no harm.”

Climate Change: The Clock is Running

Growing awareness of socially responsible investment has driven NGOs, governments, and other policymakers to position it as a fundamental component of new regulations. Although this is a separate topic, let’s examine some of the significant events that have shaped the responsible era.

The United Nations Conference on the Human Environment, held in Stockholm in 1972, was the first worldwide conference to make the environment a prominent concern. Participants adopted a set of environmental management principles, which included the Stockholm Declaration. The latter elevated environmental issues to the forefront of the international agenda and marked the beginning of a dialogue between industrialized and developing countries on the relationship between economic growth, air, water, and ocean pollution, and the well-being of people worldwide.

The 1997 adoption of the Kyoto Protocol was an international landmark since it was the first legally binding treaty to reduce greenhouse gas emissions under the United Nations Framework Convention on Climate Change. However, since many major emitters were not part of the Kyoto reduction targets, it only covered about 18% of global emissions.

The 2015 Paris Agreement is the follow-up treaty to the Kyoto protocol and unifies all nations in a joint agreement to restrict global warming to far below 2 degrees Celsius, preferably 1.5 degrees Celsius. This requires net-zero emissions by half of the 21st century. The UN has further estimated that limiting global average temperature increase to 1.5 C requires an emissions reduction of 45% by 2030 (or 25% to limit warming to 2 C).

Unfortunately, governments globally are not on track to deliver. The latest UN update states that the emission reduction activities of all 193 states together – officially called “national determined contributions” – still lead to sizable emissions increase by 2030 of about 14% compared to 2010 – far off the required objectives.

This also highlights the vital role of the private sector in meeting the Paris goals. But for investors to successfully channel capital to greener, more sustainable solutions, cohesive data is required.

Accounting regulation, success through transparency

In 2021, the G7 agreed on a historic step to make climate and sustainability reporting mandatory. As a result, the International Sustainability Standards Board (ISSB) was founded. The ISSB, which is backed by the IFRS Foundation, has now developed a prototype for a global climate and sustainability baseline reporting.

Also the European Union has compiled an comprehensive updated for its non-financial disclosure requirements which is currently in the finalization phase: the Corporate Sustainability Reporting Directive (CSRD) is supposed to become binding by 2024.

Unfortunately, even though we are moving in the right direction, these standards are not yet fully agreed or adopted. Therefore, still today the key criticism of investors is the lacking quality and cohesiveness of available ESG data. Since the large majority of companies are not required to report any information on sustainability yet, ESG data providers develop estimates and use methodologies that vary from vendor to vendor. The consequences are deviating results and loss of confidence in the available information.

Mandatory reporting of relevant sustainability information is the key requirement for data to improve and to become comparable. Only then can investors and other stakeholders reliably work with ESG data and come closer to the overall aim: that sustainability data is as reliable and valued as financial data.

We could elaborate further, but that is beyond the scope of this article. This was simply to highlight the fact that, from investors to policymakers, ESG factors are being closely implemented and monitored around the world.

SRI and Performance, hand-in-hand

When assessing SRIs, financial performance is, predictably, the most common concern of advisors. However, SRI and performance do coexist over the long term. According to a study published by CFA, the long-term outperformance of portfolios comprised of stocks with the highest ESG ratings is substantial and consistent. Morgan Stanley also underlined in a study that, during the Covid-19 year of extraordinary volatility and recession, environmental, social, and governance (ESG) funds performed better than non-ESG portfolios – Based on a panel of more than 3,000 U.S. mutual funds and ETFs, SRI-based funds outperformed their non-ESG counterparts by a median total return of 4.3% in 2020.

As the trend toward socially responsible investing continues, businesses are learning that with a good ESG performance, they can attract more investors and strengthen customer relationships. More than ever, both investors and consumers seek out companies that share their values. Therefore, socially responsible investing has built a bridge between implementing positive change and wealth generation.

In terms of corporate sustainable responsibility, Microsoft is widely regarded as a top performer; It is a leading holding in many SRI ETFs. In recent years, the corporation has achieved carbon neutrality, decreased product packaging by 20%, and contributed software services worth billions of dollars to communities and non-profit organizations. For instance, the company is utilizing artificial intelligence to tackle global warming in India by providing software tools to enhance agricultural output.

Thus, we can conclude that there is no performance cost associated with Socially Responsible Investing; both large and small companies are joining the movement, which is still in its infancy. In their 2017 study, Brière, Peillex, and Ureche-Rangau confirmed this assumption, establishing that there were no apparent costs associated with SRI investing, even with exclusionary techniques. Investors can have a positive impact while generating financial returns.

The bottom line

SRI has become an essential component of the economy and is expected to continue to grow. Customers and shareholders frequently demand that firms take actions to enhance their ESG performance, for example to improve their emissions management and target setting in line with the Paris Agreement.

Shareholder activism has compelled businesses to re-evaluate their own operations and invest in shareholder-valued causes. One widely discussed example is the successful campaign of activist investor Engine No.1 that forced Exxon Mobil to replace several members of ExxonMobil’s board with independent, more climate conscientious candidates.

Both shareholders and other stakeholders have become more aware of the impact they can have on the social and environmental agenda of companies.

If you’d like to learn more about SRI Investing you can also check out the recently published ‘Sustainable & Responsible Investing 360°: Lessons Learned from World Class Investors’, which contains in-depth interviews with 26 leading SRI investors and you can obtain your copy here. You can also listen to the SRI360 Podcast, which features a range of interviews with world-class investors across all asset classes.