In the wake of prolonged global economic turmoil that has followed the Covid 19 pandemic, a number of recurring questions have arisen, notably how to build back better, more inclusively and holistically, amidst these new global challenges.

Investors, too, are driven to make positive change and have embraced impact investing in greater numbers than ever before: The impact investing market size was estimated to be worth $715 billion in 2020, which represented a 42 percent increase from $502 billion a year earlier. By comparison, the Global Sustainable Investment Alliance (GSIA) estimated that global responsible assets under management (AUM) totalled $35 trillion. So, despite the explosive growth and increased interest by asset owners and managers, impact investing remains a small market niche representing only about 2 percent of global responsible AUM.

It’s becoming clear that private impact capital will be increasingly required to find solutions to the world’s important problems. Accordingly, impact investing has become a priority in global asset allocation strategies and many investors are on the lookout for investments that provide positive and quantifiable social and environmental impact in addition to financial rewards.

Defining Impact Investing

In a nutshell, impact investing is the process of making financial investments in companies whose activities target a positive environmental and social impact that is measurable, while at the same time achieving a predetermined financial return.

Nevertheless, it is critical to distinguish impact investing from pure ESG practices. While the latter is primarily looking at certain environmental, social and governance criteria, impact investing is aimed at actually creating a measurable impact on society and/or the environment addressing specific problems in a quantifiable way. In other words, impact investing goes beyond pure ESG investing.

Impact Essentials

The GIIN (Global Impact Investing Network) outlined the following key features of impact investing:

1. Intentionality

Impact investing is defined as a deliberate goal of generating quantifiable positive social or environmental benefits. Impact investors seek to resolve issues and capitalize on prospects. This is what distinguishes impact investing from other investment strategies that may include impact considerations.

2. Use Evidence and Impact Data in Investment Design

When accessible, impact investing must rely on evidence and data to make sound investments that contribute to the achievement of social and environmental goals.

3. Manage Impact Performance

Impact investing is driven by a specific goal and requires that assets be handled accordingly. This includes establishing feedback loops and communicating performance data to assist other stakeholders in the investment chain.

4. Contribute to the Industry’s Growth

When conveying their impact strategies, objectives, and performance, investors with credible impact investing practices employ industry-standard terminology, norms, and measurements. Additionally, they share their experiences so that others can benefit from their knowledge of what truly adds to social and environmental benefits.

Impact Players

Impact investing has garnered a huge spectrum of individual and institutional investors, including

1. Fund managers, banks, pension funds, insurance firms, and other financial institutions

Such institutions can capture the attention of some of their clients by offering impact investing solutions that aim to produce both positive impact and yield.

2. Private foundations and family offices

Impact investing enables them to leverage significantly more assets to advance their core social and/or environmental objectives while preserving or growing their endowment.

3. Government investors and development finance institutions

They can demonstrate financial viability to private sector investors while also addressing certain social and environmental objectives.

Other prominent actors have also entered the impact investment space, such as NGOs and religious institutions.

Making Impact Real – Real Impact

Impact investment is rapidly gaining appeal as it transitions from niche to mainstream. Increased awareness of sustainability challenges has fueled this growth. As a result of institutional initiatives to increase their investment product offerings, investors have developed more efficient strategies and products to incorporate into their portfolios. Here’s a few examples of leading players in the impact investment field:

1. Elevar Equity

Elevar Equity has been at the vanguard of impact investing since 2006, striving to connect low-income communities’ economic competitiveness and vibrancy to capital markets. The team is committed to resolving access and inequality issues through seed capital investments in entrepreneurs and businesses with a significant connection between impact and profit.

Taking the words of Sandeep Ferias, one of the co-founders: “In the context of a particular company and its product or service, we look at what is ‘underserved’, what is ‘marginalized’. What is ‘lack of access?”.

“Elevar Investment Method” has democratized vital products and services for over 40 million low-income households in India and LATAM, with $210 million invested across five funds and over 40 projects. Additionally, the corporation said that its contribution resulted in the creation of 75,000 positions.

2. Nuveen

Nuveen, a fund manager established in the United States, is well-known for its long history of managing funds for nonprofit organizations such as universities and their employees. Additionally, the organization is renowned for its pioneering sustainable investment strategies.

The institution’s commitment traces back to 1970 when they started leaning towards product safety and social issues. Today, the firm manages $49 billion in ESG-focused strategies, which drives its entire structure and message.

Nuveen estimates that their impact investing funding helped over 200 companies and fund managers to provide financial services, healthcare, and education to underrepresented clients in emerging nations while preserving 20,000 affordable housing units across the United States from 2009 to 2018.

3. Ecosystem Investment Partners

Ecosystem Investment Partners, a private equity group, was founded in 2006 with the goal of balancing economic development and environmental restoration, believing that not only can healthy economic growth coexist with healthy natural systems but that these historically antagonistic forces may strengthen one another.

Nick Dilks, a managing partner of the company, pointed out that “if conservation and restoration can form the basis for a viable and sustainable business, then it becomes a perpetual motion machine for both development and environmental restoration”.

In 2020, the firm raised $454 million in its third round of institutional capital, EIP IV, enabling it to expand into new restoration markets – it intends to commit around US$30 million to the cleanup and restoration of portions of 16,500 acres of Louisiana wetlands. The project includes land that will earn federal environmental restoration credits, which will be later sold to developers and government agencies to offset the environmental impact of their projects.

But What’s the Cost?

Financial performance assumptions for impact investors vary considerably. For instance, while Barber, Morse, and Yasuda (2019) observed that impact funds generated 4.7% points lower internal rates of return (IRRs) than regular venture capital funds between 1995 and 2014, Morgan Stanley reported that both categories fared similarly.

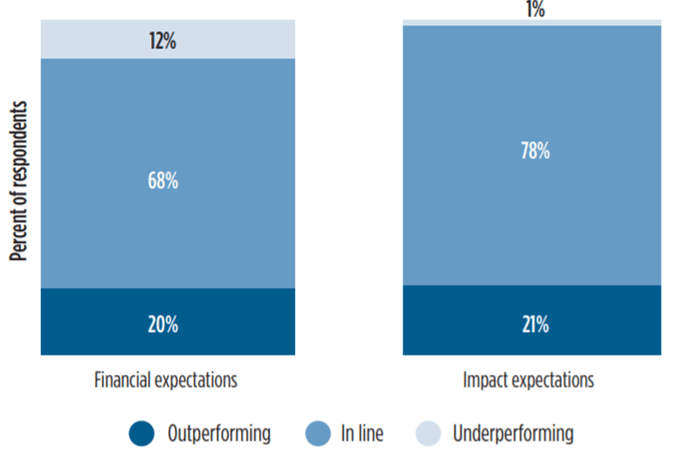

Ultimately, the performance of impact investments is strongly reliant on one’s strategy and objectives. Certain investors allocate with the intention of earning below-market returns in order to accomplish their strategic objectives. Others seek to achieve market-competitive returns or outperform the market (which is the case for the majority of investors, as revealed in a GIIN survey). Interestingly, those surveyed reported that their portfolios met or exceeded their expectations, both in terms of impact and financial performance.

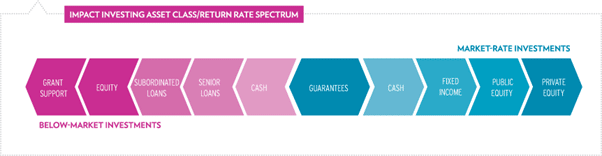

Additionally, numerous tools exist to assist impact investors. Guarantees enable the channeling of private funds to beneficial operations, reducing risk and providing favorable outcomes for the investment’s beneficiaries. Same for grants – grantmakers such as family offices, private foundations, and development finance organizations also play crucial roles in solving societal concerns in communities worldwide. In addition, subsequent grantmaking initiatives enable investors to leverage their commitments, thereby enhancing the underlying impact and financial performance.

Blended finance is widely used by development banks and foundations to attract private capital impact investors. By accepting concessional, below-market rates on their allocations, they attract more private capital, which has the effect of leveraging their investments (these investors often take “first loss” stakes).

Impact Investing – Equity Funds

The following is a quick look at some prominent, publicly traded impact investment funds:

Triodos

- Strategy – The fund’s objective is to generate positive social impact and competitive financial returns by investing in a concentrated portfolio of listed small and mid-cap companies that are pioneering the transition to a sustainable society.

- Assets under management (AUM) – $611 million as of July 2022

- Location – Luxembourg.

- Expense ratio – 0.70%.

Triodos Investment Management is a subsidiary of Triodos Bank, a bank established in the Netherlands that manages more than a dozen sustainable investment funds. Since 1995, Triodos has been an active participant in impact investing, amassing roughly $5 billion in assets.

Renewable energy, sustainable food and agriculture, healthcare, and education are some of the organization’s core areas of interest. Triodos co-founded the Global Impact Investing Network. It has investments in Europe, Latin America, Africa, India, and Southeast Asia.

BlackRock

- Strategy – The fund invests in businesses across the globe whose products and services tackle critical global social and environmental concerns while also generating financial gains.

- Assets under management (AUM) – $261 million as of July 2022.

- Location – Ireland.

- Expense ratio – 1.70%.

BlackRock does not need any introduction: it is the world’s largest asset manager, managing over $9 trillion in assets. The firm has made an effort in recent years to portray itself as a leader in promoting environmental and social sustainability. This resulted in the establishment of the Global Impact Fund, which seeks to balance financial returns with social and environmental goals. If you want to know more, I recently interviewed Eric Rice, the fund manager and you can listen to the full interview here.

Rize ETF

Rize Environmental Impact 100 Fund:

- Strategy – The fund invests in the 100 most innovative and influential enterprises that stand to gain from the development and implementation of solutions to the world’s most critical climatic and environmental concerns, as defined by the European Taxonomy of Sustainable Activities.

- Assets under management (AUM) – $14 million as of July 2022.

- Location – Ireland.

- Expense ratio – 0.55%.

Rize ETF is Europe’s leading issuer of specialized thematic ETFs. It is committed to challenging the orthodoxy and providing investors with transparent access to the most revolutionary megatrends shaping the planet. Quoting Stuart Forbes, co-founder of the firm, “Our planet is under unprecedented threat, and we need to act collectively now. To do so, we must put our hands in our pockets and vote with our capital”.

Impact Investing – Green Bond Funds

Green bonds are another sort of impact investment that has gained in popularity over the last several years. It displays an impressive market value of $1 trillion, which is predicted to expand to $5 trillion in 2025.

In short, a green bond is an issuer’s (non-binding) commitment to using the proceeds from the sale of the bond for ecologically friendly projects. These may include renewable energy projects, energy-efficient building development, and investments in clean water and transportation. Green bonds are a subset of sustainable bonds, which contain fixed-income instruments with revenues designated for social or environmental objectives.

Fidelity Environmental Bond Fund and the Amundi Responsible Investing – Impact Green Bonds Fund as two examples of impact-oriented green bond funds. We specifically mentioned these because, despite their identical look, they fall into two distinct sub-categories.

Green bond funds consider, analyze, and integrate relevant ESG factors into their investment strategy. In contrast, green bond impact funds take a more comprehensive strategy, encompassing not only these components but also rigorously measuring the positive impact achieved.

Impact Investing – Alternative Assets Funds

Last but not least, we could not leave out alternative asset funds, which now comprise a significant portion of investor portfolios. A number of them are devoted to impact investment, and here are three noteworthy examples:

BlueOrchard Finance, headquartered in Switzerland, operates in over 90 developing and frontier regions globally, including Asia, Latin America, Africa, and Eastern Europe. The firm was established in 2001 as part of a United Nations effort and has grown to become the world’s largest commercial manager of microcredit investments.

With a focus on providing finance and equity to businesses and organizations, with an emphasis on hunger and poverty alleviation, entrepreneurship, food production, education, and climate change mitigation, BlueOrchard has supported approximately 230 million low-income people in emerging and frontier markets. Blue Orchard Microfinance Fund (BOMF), the firm’s most popular investment vehicle, manages $2.8 billion in assets.

Bridges Fund Management has been driven by a shared conviction that business and investing can make a significant contribution to resolving some of the world’s major social and environmental concerns. Since its inception, the team has focused on carefully researching trends to develop investment solutions that can contribute to making the economy more equitable and sustainable, ultimately unlocking long-term economic value.

The firm invests in growing companies that contribute to a more equitable and sustainable future through its Sustainable Growth Funds. To date, it has raised over $320 million and backed 41 ventures.

Calvert Impact Capital is a market leader in global impact investing, having raised more than $2 billion through its innovative and accessible investment solutions. The organization invests to connect capital to areas in most need, demonstrating that private capital can be successfully deployed in places that are frequently disregarded and underserved by traditional finance in order to create broad economic possibilities and protect the environment. If you would like to learn more, I recently interviewed Calvert’s CEO, Jenn Pryce and you can listen to the interview here.

The bottom line

Access to impact investment has become increasingly standardized while it has evolved into a significant component of global investors’ asset allocation strategies and a critical aspect of corporate governance. These days, a plethora of impact investment vehicles exists to meet investors’ yield and sustainability objectives.

As investors and human beings, we have an urgent need to address the global crises confronting our planet and population. Values and profit no longer have to be mutually exclusive – Impact investing enables investors to demonstrate their commitment to responsible investing without compromising results. Furthermore, it enables recipients to grow sustainably, creating an inclusive circle of progress.

Impact investing enables investors to contribute to social and environmental change that benefits our planet and future generations.