Sustainable & responsible investments (SRI) not only align our personal values with our financial goals, but directly contribute to a more sustainable, equitable, and healthy world. Environmental, Social, and Governance (ESG) issues are at the heart of today’s major global problems – and deploying capital to help solve those issues has never been more vital, or easier for investors to do. One significant sector that has an outsized impact when it comes to social and environmental issues is real estate development.

The Stark Reality of Realty

As the climate crisis worsens, buildings are aging and they need to be refurbished within a 30-year life cycle, if they are to achieve carbon neutrality. Meanwhile, the real estate sector is responsible for 29 percent of all greenhouse gas emissions in the EU and 38 percent of energy consumption, making real estate the single largest sector in terms of environmental impact.

But for all intents and purposes, there has been a relative lack of focus on real estate in terms of getting to net zero greenhouse gas emissions. Although great strides have been made to make buildings more energy efficient, that progress is being significantly undermined because more square footage is constantly being built. Over the past 10 years, despite laudable progress, energy intensity per building has not fallen but has risen rather dramatically.

Get in the Boat… or Risk Drowning

I recently interviewed Basil Demeroutis – Managing Partner of FORE Partnership – a purpose-driven real estate investment firm active in the UK and Western Europe. Its mission is to enhance financial returns for investors by driving environmental sustainability and positive social outcomes. Demeroutis described how investors have historically suffered punitive results whenever they missed out on big systemic changes − like those now underway in the SRI-focused real estate investment world.

“Even if you picked the best tobacco company in the ‘70s,” he points out, “it didn’t matter because you would have always been trumped by any tech company you could have invested in, instead.” His experienced view is that a purposeful, SRI approach to investing is fast becoming a prerequisite for success.

In other words, investors are destined to lose out if they ignore this momentous paradigm shift, regardless of their personal ethics or what they think of climate change science. Demeroutis declares, “The secular shift toward thoughtful, purposeful, responsible investment trends grounded in climate is so powerful, in fact, that if you’re not in the boat, you’re drowning.”

Recognizing Buildings as Agents of Change

He and other thought leaders in this space see buildings as not just energy-gluttons that must quickly be retrofitted to save the planet. They also acknowledge that buildings have the potential to deliver powerful, positive social outcomes.

As Demeroutis explains, “When you think of our urban systems in an interconnected way, you start to realize that buildings are actually at the center of change.” If, for instance, you’re trying to tackle food insecurity, poverty, or jobs and skills training, where will you do that? Probably in a building, because that is where humans spend 80 to 90 percent of their time.

So, no matter what kind of social program or initiative is implemented, that activity is almost always organized and carried out within the built environment. Buildings house government agencies, educational institutions, social organizations, non-profits, health care facilities, transportation hubs, retailers and workplaces, and vital infrastructure.

Livable Assets Leveraged for Social Improvement

Buildings can and do have a negative impact on many communities, but they can also be valuable assets strategically leveraged for positive change. The assets that Demeroutis and his team invest in are primarily focused in two areas. Two-thirds of the portfolio is invested in offices, and the rest in what he refers to as living spaces. Those are comprised of affordable micro apartments in cities, senior living facilities, and urban housing for marginalized populations at risk of homelessness.

“We try to drill ESG into every aspect of the building,” says Demeroutis, “from design to operation.” That typically includes a multi-functional space that tenants in the building can use, and programming activities conducted in partnership with local social enterprises and community groups. “It might be a school that needs a space to run an art exhibition for their kids for a week,” he explains, “or for a fundraiser or skills workshop. I think that integration of community, both within the building and without the building, is really essential, in terms of integrating the ‘E’ and the ‘S’ of ESG.”

In that way, such real estate investments create opportunities for impact at multiple levels, while effectively addressing multiple problems.

Buildings with a Sense of Community Purpose

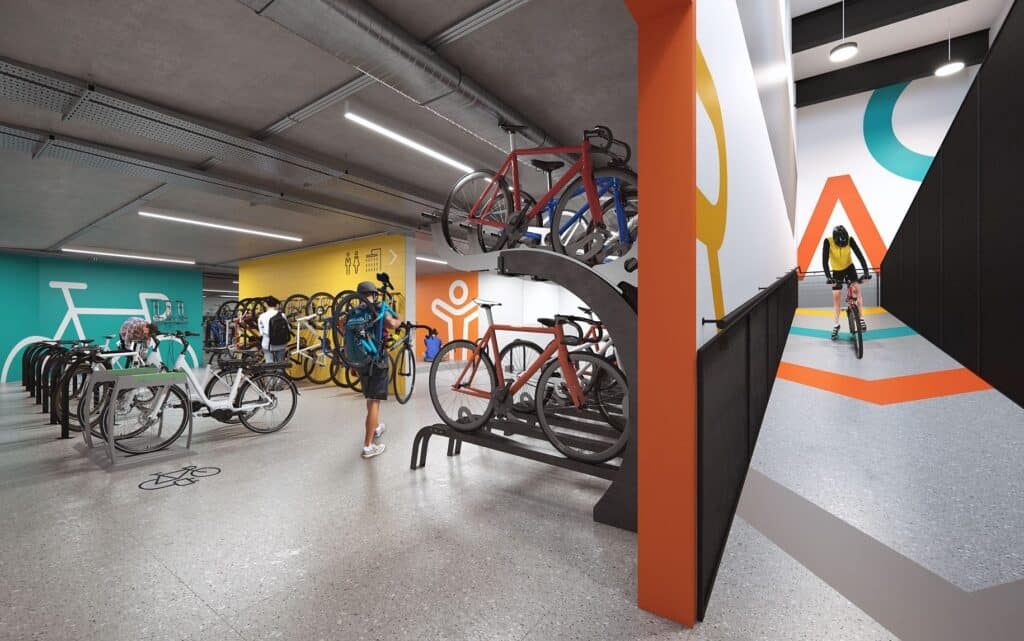

A good example is Cadworks™, located in Glasgow, Scotland. When it was refurbished, the parking garage was completely removed. In its place is now a state-of-the-art cycling facility where residents of the building can hire a bike. People with disabilities have equal access, including an attractive glass ramp that runs through the reception area.

A local enterprise that repairs old bicycles partners with the building management to employ and train residents as bike mechanics. The bikes they repair are given to children whose families are challenged by poverty, to those who lack affordable transportation to and from work, or to those who need them for exercise to stay healthy.

There’s a bike repair shop in the building, and a food shop operated by an organization feeding those suffering from food insecurity. Those meals are delivered by bicycle, so the building and its social components represent a community with a special interconnected sense of purpose.

The Bottom Line

The structures in which we live and work are responsible for approximately 40 percent of global CO2 greenhouse gas emissions. Yet little has been done to reduce those emissions, which illuminates a serious problem – while simultaneously highlighting a golden opportunity for investors to do a lot of good in the world and be financially rewarded for the effort.

You can listen to my complete interview with Basil Demeroutis here.

You can also read about the investment strategies of other highly successful SRI Investors I interviewed for my newly released book ‘Sustainable & Responsible Investing 360°: Lessons Learned From World Class Investors. The book contains 26 interviews with a variety of leading SRI investors. You can find a sample chapter and the full table of contents here. Purchase your copy of the book here.