Natural resources, such as soil, air, water and all living things are the fundamental building blocks which enable our society to function and continue to further evolve. These resources are referred to as “natural capital” because they are directly linked to the valuation of biodiversity and ecosystems.

The World Economic Forum has estimated that over half of global GDP relies directly or indirectly on natural capital which means that the world’s population depends heavily on nature and natural resources. At the same time, we are utilizing or extracting resources quicker than they can replenish themselves and we are creating negative externalities such as pollution, that eventually harm nature, and reduce its efficiency and resourcefulness.

Natural Capital: A Misunderstood and Underestimated Framework

Threats to the world’s natural capital and biodiversity are increasingly being recognized to be closely linked to climate change and this is likely to be the next big shoe to drop in sustainability investing. Natural capital ranges from the minerals and fuels we extract to the bees that pollinate plants, the water we drink, and the air we breathe to stay alive.

Yet there’s still no consensus regarding how to measure and evaluate the challenges in natural capital. Despite its vital importance, it is not focused on as much by investors – which presents an underrated investment opportunity.

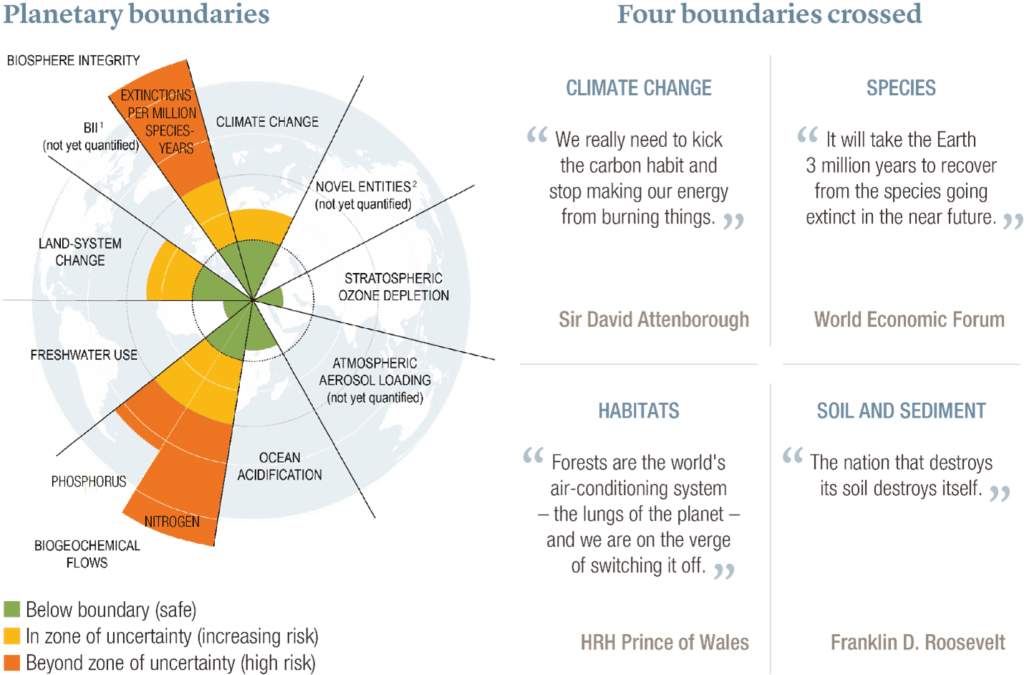

Building on the Planetary Boundaries Theory

One fund keenly focused on this opportunity is LO Funds Natural Capital, led by Portfolio Manager Alina Donets and launched in November, 2020 by Lombard Odier Investment Managers. Out of an investable universe they have identified of approximately 600 companies, the fund has built a high conviction portfolio of 40 to 50 publicly listed companies that are contributing to the preservation and protection of natural capital or the development of technological solutions for nature and the environment.

I recently spoke with Alina (listen to the entire interview) who emphatically states that it is “vital we ensure that we fully utilize and harness the power of the regenerative aspects of natural capital − and preserve those that have a finite resource.” She and her team have developed a framework which builds on the “planetary boundaries” theory. This helps them monitor humanity’s footprint on natural capital. The proprietary concept helps measure and quantify the risks humans take regarding the resources used. Then it turns them into investment opportunities, thereby eliminating the human footprint over time.

Planetary boundaries is a theory developed at the Stockholm Resilience Centre. It pertains to the capabilities of the planet, and the biodiversity necessary to keep those capabilities functioning normally. Alina shares a classic example: “Nitrogen and phosphorus pollution stemming from agricultural activities have increased to levels where that has significant negative impact on biodiversity. We exceeded the limits of the planet to actually absorb and manage these, affecting the environmental balance.” Following that logic, the agriculture industry is limiting its own sustainability in a tragically ironic or paradoxical consequence.

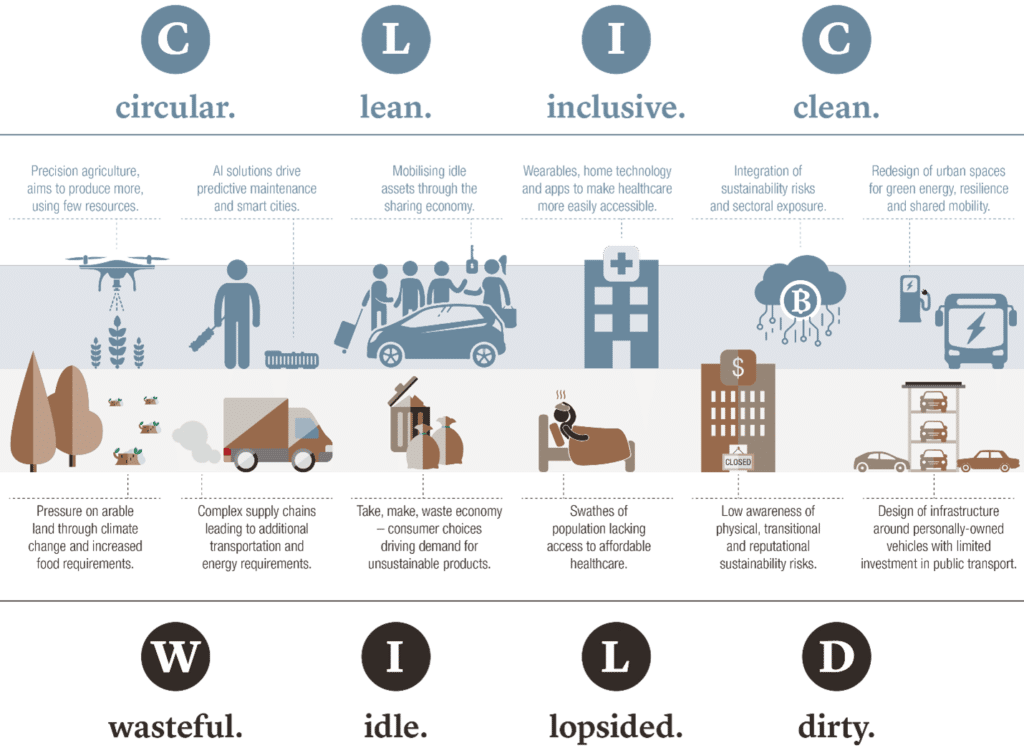

The WILD Versus CLICTM Economies

Alina and her team realize that healthy natural capital is as good for capital gains as it is the environment. They contrast the WILD (Wasteful, Idol, Lopsided, and Dirty) economy versus the CLICTM (Circular, Lean, Inclusive, and Clean) economy. As Alina explains, “the WILD concept represents the traditional approach and CLICTM represents the number of targets that we, as a company, think is essential to achieve when it comes to sustainable investing.” She cites the example of Lombard Odier’s LO Funds Climate Transition, which invests in solutions to climate change problems to help build resilience to climate change to directly support the “Clean” aspect while indirectly supporting the other three objectives of CLICTM.

Meanwhile in LO Funds Natural Capital, she does not specifically target reducing carbon emissions. Instead, the fund invests in companies that help to:

1) create a leaner utilization of resources during the manufacturing and consumption processes,

2) help combat the waste challenge, and

3) create biologically based solutions to replace some of the finite or damaging resources our economy currently utilizes.

Integrated Assessment of Value

Of course, for any sustainability-focused fund, there is always the question of the purity of the companies invested in. In this case, the companies invested in do not need to be 100% exposed to the natural capital activities that are the fund’s focus.

“We would not invest in a company,” says Alina, “that has less than 30 percent of their business in activities that positively contribute to natural capital preservation or harnessing of nature.” She adds that when looking at the average fund value, they are getting close to 60 to 70 percent exposure. Instead of weighing different aspects of sustainability they view them as equally important. This means that a company’s contribution to positive objectives forms one component of an integrated assessment leading to a conviction formation. Other components ask whether the company’s financials reflect the opportunity and offer an attractive ROI.

Transparency is the Key

The fund also strives to be an active shareholder and stakeholder by meeting with the companies regarding not just environmental, social, and governance aspects but also to advocate for transparency on key business activities that create positive impact. Alina explains that the reason for doing this is that they “truly believe that capital allocation and effective communication can eventually translate into improved decision-making at the corporate level,” to inform management’s long-term strategy and capital allocation to better meet investors’ objectives.

The actual assessment to determine where and how much to invest is contingent upon the cost of the technology involved, the seriousness of the specific problem a company is trying to eradicate, and the overall efficiency of the company. Her company’s efforts toward a CLICTM economy are validated by exponential growth in asset value. The fund was launched with $400 million in seed money in 2020. Interest was so great that Assets Under Management increased by another $500 million the following year. Improved regulations and greater transparency have only advanced this effort, as Europe wakes up to the pressing need for environmental reform.

Alina says that transparency is the key to moving forward toward an economy more aligned with the CLICTM framework. “Better information allows for improved effectiveness of capital allocation and better communication to support better outcomes for investors and the planet.”

To learn more about Natural Capital Investing, listen to my complete interview with Alina Donets here.

This article is based on a discussion of Natural Capital Investing from my book ‘Sustainable & Responsible Investing 360°: Lessons Learned From World Class Investors’ in the chapter on public equities investing. The book contains 26 interviews with leading, world-class SRI investors, and presents the diversity of approaches that they are using to empower investors to deploy capital in a more sustainably rewarding and life-giving way. You can obtain your copy here.